Welcome to Mexico Custom Homes

1902 Wright Pl Ste.200

Carlsbad, CA, 92008

Send Your Mail At

Working Hours

Mon-Sat:9.30am To 7.00pm

- 0 Comments

- By Xeeshan

Legal Structures for Foreign Investment in Mexican Property (2025)

Foreigners can invest through three main paths. Outside the restricted zone, you may take title in your own name after signing the foreigner’s agreement with the Ministry of Foreign Affairs. In the restricted zone, you must use a bank trust called a fideicomiso for residential use.

For non-residential use in the restricted zone, a Mexican company can hold title if it files the required notice. In all cases, a Mexican notary public prepares the deed, collects taxes, and registers title.

Expect an SRE permit fee for a trust, a state acquisition tax at closing, annual property tax, and standard compliance checks against Mexico’s anti-money laundering law.

How ownership works in Mexico, at a glance

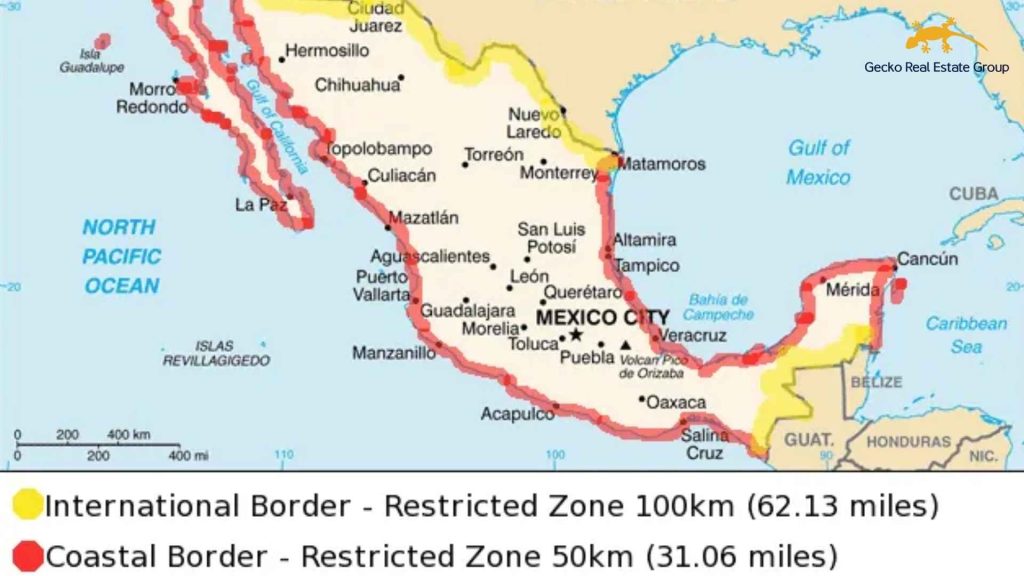

The restricted zone

The Constitution restricts direct foreign ownership within 50 km of the coast and 100 km of international borders. Residential property there must be held through a fideicomiso. Mexican companies with foreign owners may hold non-residential property in the restricted zone if they file the SRE notice.

Outside the restricted zone

Foreigners may take direct title in their own name after agreeing to be treated as Mexican nationals for the property, known as the Calvo clause, processed with the SRE.

Structure options and when to use them

| Structure | Where it works | Typical use | Key permits and filings | Pros | Cons |

|---|---|---|---|---|---|

| Direct deed in your name | Outside restricted zone | Residential or investment | SRE foreigner’s agreement for property outside restricted zone | Simple. No trust fees | Not allowed inside the restricted zone for direct ownership |

| Fideicomiso, bank trust | Inside restricted zone | Residential ownership and rentals | SRE trust permit. Trust with a Mexican bank. 50 years, renewable | Legal path to own near beaches and borders. Full use and enjoyment rights | Setup fee and annual bank fee. Changes require bank instructions |

| Mexican company, S. de R.L. de C.V. or S.A. de C.V. | Anywhere, including restricted zone for non-residential use | Rentals as a business, development, hotels, commercial | SRE notice for non-residential restricted zone acquisitions. RNIE registration and reports | Works for commercial use in restricted zone. Flexible partnership options | Corporate upkeep. RNIE and tax filings |

SRE fees include 19,950 MXN for the trust permit and 1,360 MXN for the corporate notice when filed on time. Both are listed by the Foreign Affairs Ministry.

The fideicomiso, the bank trust foreigners use in the restricted zone

What it is

A Mexican bank holds legal title. You are the trust beneficiary with the same property rights as an owner. You can use, lease, improve, sell, and bequeath the property. The trust term is 50 years and can be renewed.

Legal basis and permit

You need an SRE permit to establish the trust. The current government fee and response time are published by SRE. The fee is 19,950 MXN, with a typical response in five business days.

Changes, inheritance, and cancellation

You can add or change beneficiaries by instruction through the bank and a notary. If you later sell to a Mexican citizen, the trust can be extinguished at closing and title transferred directly. An extinction notice goes to SRE.

Using a Mexican company for investment

When a company makes sense

For hotels, vacation rental operations at scale, or other non-residential uses in the restricted zone, a Mexican company can hold title. The company must file an SRE notice of the acquisition in the restricted zone for non-residential use. Fees are posted by SRE.

Entity types investors use most

The two common forms are S. de R.L. de C.V. and S.A. de C.V. Mexican tax rules treat them similarly, but many U.S. investors prefer S. de R.L. for U.S. “check-the-box” pass-through treatment.

RNIE registration

Any Mexican company with foreign investment must enroll in the National Registry of Foreign Investments and file periodic reports.

Sector limits still apply

Some activities have foreign ownership caps. Real estate for tourism or rentals is generally open, but always screen your business line against the Foreign Investment Law and current reviews.

Outside the restricted zone, direct ownership is straightforward

You may buy directly in your own name. The SRE processes the standard agreement in which foreigners accept to be treated as nationals for property purposes. The notary then issues the deed and registers it.

What a Mexican notary public does at closing

A notario público is a highly trained public official. The notary verifies seller’s title and identity, drafts and reads the deed, calculates and pays taxes, and files the deed with the Public Registry of Property. The notary’s job is to prevent disputes and give legal certainty.

“El notario da autenticidad a los hechos y actos ocurridos en su presencia, por poseer fe pública. (The notary authenticates the facts and acts that occur in his presence, as he has public faith.)”

Title registration and key searches

Your deed must be recorded with the Public Registry of Property in the state where the property sits. Standard due diligence includes a no-lien certificate and zoning checks.

Ejido land and the federal beach strip

Ejido land

Ejido land is communal agricultural land. Foreigners cannot buy ejido rights. Only once land is fully regularized into private property can it be deeded and recorded. Many scams involve unregularized ejido parcels, so take special care.

The federal maritime land zone, ZOFEMAT

The first 20 meters from the high-tide line is a federal strip. No one owns it. Use requires a concession from SEMARNAT. Private lots begin after the ZOFEMAT line.

Taxes and ongoing costs you should budget

Acquisition tax at closing, ISAI

States charge a one-time property acquisition tax at transfer. Rates vary by state, often in a range of about 2 to 4.5 percent of the higher of deed price or assessed value. The notary calculates and pays this at closing.

Annual property tax, predial

Municipalities levy predial annually on the cadastral value. Rates are low by international standards. Typical ranges are around 0.1 to 0.3 percent, depending on the city.

Rental income tax for non-residents

Non-residents with rental income sourced in Mexico generally face a 25 percent withholding on gross rents, with no deductions under the standard regime. Other options can apply if you appoint a tax representative and meet conditions.

Capital gains tax for non-residents

On a sale, the default non-resident tax is 25 percent on gross proceeds. There is an option to tax 35 percent on net gain if you appoint a Mexican representative and meet formalities in a notarized deed. Plan this before you sign.

Trust and closing fees

Trust setup and annual administration fees vary by bank. The SRE trust permit fee is set by the government. Banks publish schedules for opening and annual fees.

Compliance you cannot ignore

SRE permits and notices

Trusts in the restricted zone require an SRE permit. Mexican companies acquiring non-residential property in the restricted zone must file an SRE notice. Official fees and times are posted by SRE.

RNIE filings

Companies with foreign investment must register with the RNIE and submit periodic reports. This is mandatory and separate from tax filings.

Anti-money laundering rules

Real estate closings are covered by Mexico’s AML law. Notaries verify identities and make threshold reports to SAT’s AML portal when amounts exceed legal limits. You will complete KYC forms and provide source-of-funds documentation.

Step by step, a clean purchase

Direct deed outside restricted zone

- Hire an independent attorney and choose a notary.

- Title search, no-lien certificate, and zoning check.

- SRE foreigner’s agreement processed by the notary.

- Sign deed before the notary. Notary pays ISAI and stamps the deed.

- Notary registers title with the Public Registry.

Fideicomiso in the restricted zone

- Secure SRE trust permit.

- Pick a trustee bank and sign the trust agreement.

- Notary drafts deed and trust instruments.

- Notary pays ISAI and records title.

- Bank manages the trust, you pay annual fees.

Mexican company for non-residential use

- Incorporate S. de R.L. de C.V. or S.A. de C.V.

- Register with the RNIE.

- File SRE notice for acquisition in the restricted zone if applicable.

- Notary closes, pays ISAI, files deed.

- Keep corporate, RNIE, and tax filings current.

Costs and timelines, typical ranges

| Item | Typical range or rule |

|---|---|

| SRE trust permit | 19,950 MXN, about five business days |

| SRE corporate notice, non-residential restricted zone | 1,360 MXN if timely |

| ISAI acquisition tax | About 2 to 4.5 percent, state dependent |

| Predial annual tax | Often 0.1 to 0.3 percent of cadastral value |

| Trust bank fees | Opening and annual fees vary by bank |

| Deed registration by notary | Notary collects and remits taxes, then records title |

All official SRE fees are published online and updated periodically. Verify current amounts before closing.

Special land issues near the beach

Beachfront parcels sit behind the ZOFEMAT, the 20 meter federal strip from high tide. Private owners may apply for a concession to use that strip, but no one owns it. Your private lot begins after the ZOFEMAT line. Plan site design and access with that in mind.

Frequently asked questions

Do I need Mexican residency to buy?

No. Foreigners can buy without residency. You will still need tax and identity documents for the closing, handled through the notary. Owning property does not grant immigration status.

Is the fideicomiso safe?

Yes. It is a statutory trust supervised by a regulated bank. You enjoy the same rights as an owner and can name substitute beneficiaries.

Can I use a company to buy a vacation home in the restricted zone?

You may form a company, but residential use in the restricted zone is normally handled by a fideicomiso. Company acquisitions in the restricted zone are for non-residential use and require a notice to SRE. Discuss your intended use with counsel and the notary.

What taxes apply if I rent my home?

Non-residents face a 25 percent withholding on gross rent under the standard rule. There are alternatives if you appoint a tax representative and meet conditions.

How is capital gains tax calculated when I sell?

Default is 25 percent on gross proceeds for non-residents. Some sellers may elect 35 percent on the net gain if they appoint a representative in Mexico and the deed meets formalities. Plan this before the notary drafts the deed.

What if the land is ejido?

Avoid it unless it has been fully regularized into private property and recorded. Many disputes stem from incomplete regularization.

Action checklist for a clean, compliant investment

- Define location and use. If it is beach or border and residential, plan on a fideicomiso. If it is commercial in the restricted zone, plan on a company and SRE notice.

- Retain an independent lawyer and select a notary early. The notary prevents errors, collects taxes, and registers title.

- Pull a no-lien certificate and review zoning before you pay a deposit.

- Budget for ISAI at closing and predial annually. Add trust fees if you use a fideicomiso.

- Prepare AML documents for the notary, including identification and source of funds.

- If you use a company, register with the RNIE and keep filings current.

- If beachfront, confirm ZOFEMAT boundaries and any needed concession.

- u target, with state-specific ISAI rates and a cost sheet you can hand to your notary.

Leave A Comment

You must be <a href="https://mexicocustomhomes.com/wp-login.php?redirect_to=https%3A%2F%2Fmexicocustomhomes.com%2Flegal-structures-foreign-investment-mexican-property">logged in</a> to post a comment.