Welcome to Mexico Custom Homes

1902 Wright Pl Ste.200

Carlsbad, CA, 92008

Send Your Mail At

Working Hours

Mon-Sat:9.30am To 7.00pm

- 0 Comments

- By Xeeshan

Understanding the Mexican Foreign Investment Law for Real Estate in 2025

Mexico’s real estate market continues to attract global interest, offering opportunities in coastal paradises, vibrant cities, and serene countryside. However, for foreign investors, navigating the legal landscape can be complex. The Mexican Foreign Investment Law (LIE) governs how non-Mexicans can acquire property, especially in areas near borders and coastlines. This guide provides a comprehensive overview of the law’s implications for real estate transactions in 2025.

What Is the Mexican Foreign Investment Law?

The Mexican Foreign Investment Law, enacted in 1993, regulates the participation of foreign nationals and entities in the country’s economic activities, including real estate. Its primary objectives are to:

- Promote Foreign Investment: Encourage international capital influx to stimulate economic growth.

- Protect National Interests: Safeguard sovereignty, especially concerning land near borders and coastlines.

- Ensure Legal Compliance: Establish clear guidelines for foreign ownership and participation.

Key Provisions of the Foreign Investment Law in Real Estate

1. Restricted Zones

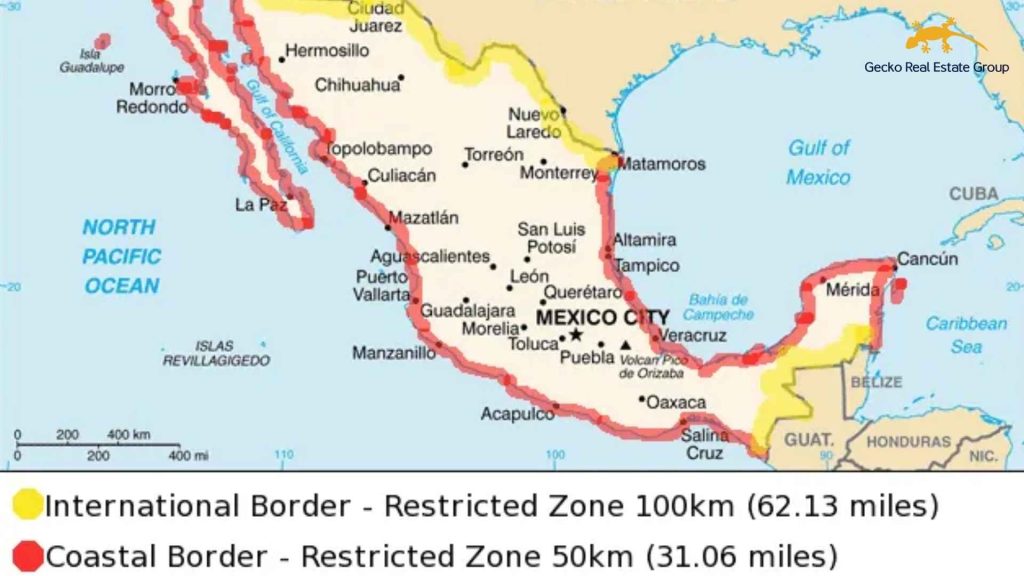

- Definition: Areas within 100 kilometers of international borders and 50 kilometers of coastlines.

- Ownership Restrictions: Foreigners cannot directly own land in these zones.

- Legal Mechanisms: Acquisition is possible through a fideicomiso (bank trust) or a Mexican corporation, depending on the property’s intended use.

2. Fideicomiso (Bank Trust)

- Purpose: Allows foreigners to enjoy property rights without holding direct title.

- Structure: A Mexican bank holds legal title, while the foreigner is the beneficiary with rights to use, lease, sell, or inherit the property.

- Duration: The trust is established for 50 years and is renewable.

- Benefits: Provides a legal framework for foreigners to invest in restricted zones.

3. Mexican Corporation Ownership

- Applicability: Suitable for commercial properties or developments.

- Requirements: The corporation must be at least 51% Mexican-owned, with bylaws permitting foreign participation.

- Limitations: Foreigners cannot use this structure for residential properties in restricted zones.

4. Permits and Approvals

- Constitutional Requirement: Article 27 mandates that foreigners must agree to submit to Mexican jurisdiction and waive diplomatic protection.

- Government Oversight: Transactions involving foreigners must be approved by the Ministry of Foreign Affairs (Secretaría de Relaciones Exteriores).

- Procedure: Applications are reviewed, and unless a denial is published within five days, the permit is considered granted.

5. Recent Legal Reforms

Anti-Money Laundering (AML) Reforms:

In June 2025, Mexico implemented stricter AML regulations affecting real estate transactions.

- Due Diligence: Increased scrutiny on the source of funds and financial background of buyers.

- Beneficial Ownership: Requirement to disclose ultimate beneficial owners, with a 25% ownership threshold for control.

- Risk Classification: Buyers are categorized into risk levels (low, medium, high) based on various factors, including nationality and political exposure.

Understanding Fideicomiso: A Closer Look

What Is a Fideicomiso?

A fideicomiso is a legal arrangement where a Mexican bank acts as a trustee, holding the legal title to the property on behalf of the foreign beneficiary. The beneficiary retains all rights to the property, including:

- Use and Enjoyment: Live in or utilize the property as desired.

- Transferability: Sell, lease, or transfer the property during the trust’s term.

- Inheritance: Pass the property to heirs upon death.

How It Works

- Establishment: The foreign buyer and a Mexican bank enter into a trust agreement.

- Duration: The trust lasts for 50 years and can be renewed.

- Control: The beneficiary directs the trustee on actions related to the property.

- Legal Framework: Governed by Mexican law, providing a secure investment vehicle for foreigners.

Ownership Structures for Foreigners

Direct Ownership (Outside Restricted Zones)

- Eligibility: Foreigners can own property directly in areas not classified as restricted zones.

- Process: Requires registration with the National Foreign Investment Registry (Registro Nacional de Inversiones Extranjeras).

- Considerations: Must comply with all local and federal regulations.

Through a Mexican Corporation

- Structure: Foreigners can establish a corporation with at least 51% Mexican ownership.

- Usage: Suitable for commercial developments or mixed-use projects.

- Regulations: Must adhere to corporate laws and include specific clauses in the corporate bylaws.

Fideicomiso (For Residential Properties in Restricted Zones)

- Mechanism: As detailed earlier, this structure allows foreigners to invest in residential properties within restricted zones.

- Advantages: Provides a legal pathway for property ownership in desirable locations.

Legal and Financial Considerations

Tax Implications

- Capital Gains Tax: Foreign sellers may be subject to capital gains tax upon selling property.

- Income Tax: Rental income is taxable in Mexico.

- Tax Residency: Prolonged stays may result in tax residency, subjecting worldwide income to Mexican taxation.

Legal Protections

- Notary Public Involvement: Transactions must be overseen by a Mexican notary public to ensure legality.

- Property Title Verification: Essential to confirm clear ownership and absence of encumbrances.

- Legal Recourse: Mexican law provides avenues for dispute resolution, though enforcement may vary.

Market Risks

- Property Valuation: Market fluctuations can impact property values.

- Regulatory Changes: Future legal reforms may affect property rights and investment returns.

- Economic Factors: Inflation, interest rates, and economic stability influence the real estate market.

Frequently Asked Questions (FAQs)

Can foreigners buy property anywhere in Mexico?

Yes, foreigners can purchase property throughout Mexico. However, in restricted zones (within 100 km of borders and 50 km of coastlines), they must use a fideicomiso or a Mexican corporation for residential and commercial properties, respectively.

How long does a fideicomiso last?

A fideicomiso is established for 50 years and is renewable upon expiration.

Are there any restrictions on selling property?

Foreign owners can sell their property at any time, subject to applicable taxes and regulations.

Do I need to be a resident to buy property?

No, residency is not required. However, obtaining a Mexican tax ID (RFC) is necessary for property transactions.

What are the costs associated with property acquisition?

Buyers should budget for notary fees, registration costs, acquisition taxes, and potential maintenance expenses.

Investing in Mexican real estate offers promising opportunities for foreign nationals. Understanding the Foreign Investment Law and its provisions is crucial to navigate the legal landscape effectively. Whether considering a beachfront property or a commercial venture, seeking guidance from legal and real estate professionals can ensure a smooth and compliant investment experience.

Leave A Comment

You must be <a href="https://mexicocustomhomes.com/wp-login.php?redirect_to=https%3A%2F%2Fmexicocustomhomes.com%2Fmexican-foreign-investment-law-real-estate">logged in</a> to post a comment.